Customer structure

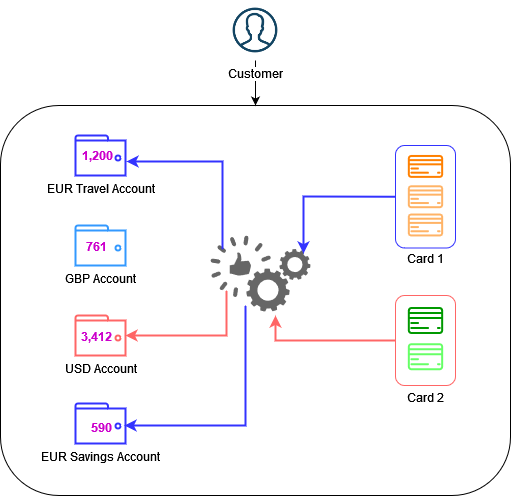

The following image gives an overview how the components relate to each other.

The customer has three components:

- Customer - Consists of the personal data

- Account - Holds the monetary value of a currency and can have one account identifier (IBAN, Sort Code Account Number)

- Card - It is a prepaid card to allow scheme transactions

Relationship between components:

- A customer can hold multiple accounts with the same or different currency together with multiple virtual or physical prepaid cards

- Accounts are not associated to any cards created under the same customer

- Cards are not associated to any accounts created under the same customer

If accounts and cards are not associated, how are funds debited from the accounts when a scheme transaction takes place? And which account is debited?

This depends on the programme design. For spend control programmes, accounts are selected based on the transaction’s MCC, for example Travel versus Food. In this case only the balance of the one account is available. Other possible programmes will select accounts differently. For example a multi currency programme could have USD, GBP and EUR accounts with the account selected depending on the transaction acquiring currency and programme defaults setting up rules for account usage and sweeps.

Card 1 is a container of cards where

light orange indicates old cards (example closed, lost, etc) and

dark orange indicate the active card. Rules at the issuing processor enables the platform to decide which EUR account to debit. On the other hand Card 2 holds a USD active card,

dark green, while the

light green is a closed card.